Quick Guide: Using RRSP for Buying a House as a Couple [With Expert Tips]

Did you know that couples in Canada can access up to $120,000 tax-free from their RRSPs to buy a house?

The RRSP Homebuyers' Plan lets each of you withdraw up to $60,000 ($120,000 total) tax-free and interest-free from your Registered Retirement Savings Plans to buy your first home. This financial tool has helped many Canadian home buyers make their homeownership dreams real.

You need to meet specific conditions to qualify. These include being a first-time home buyer and having a written agreement to buy or build a qualifying home. You should also have a steady income, good credit score, and some savings for the down payment.

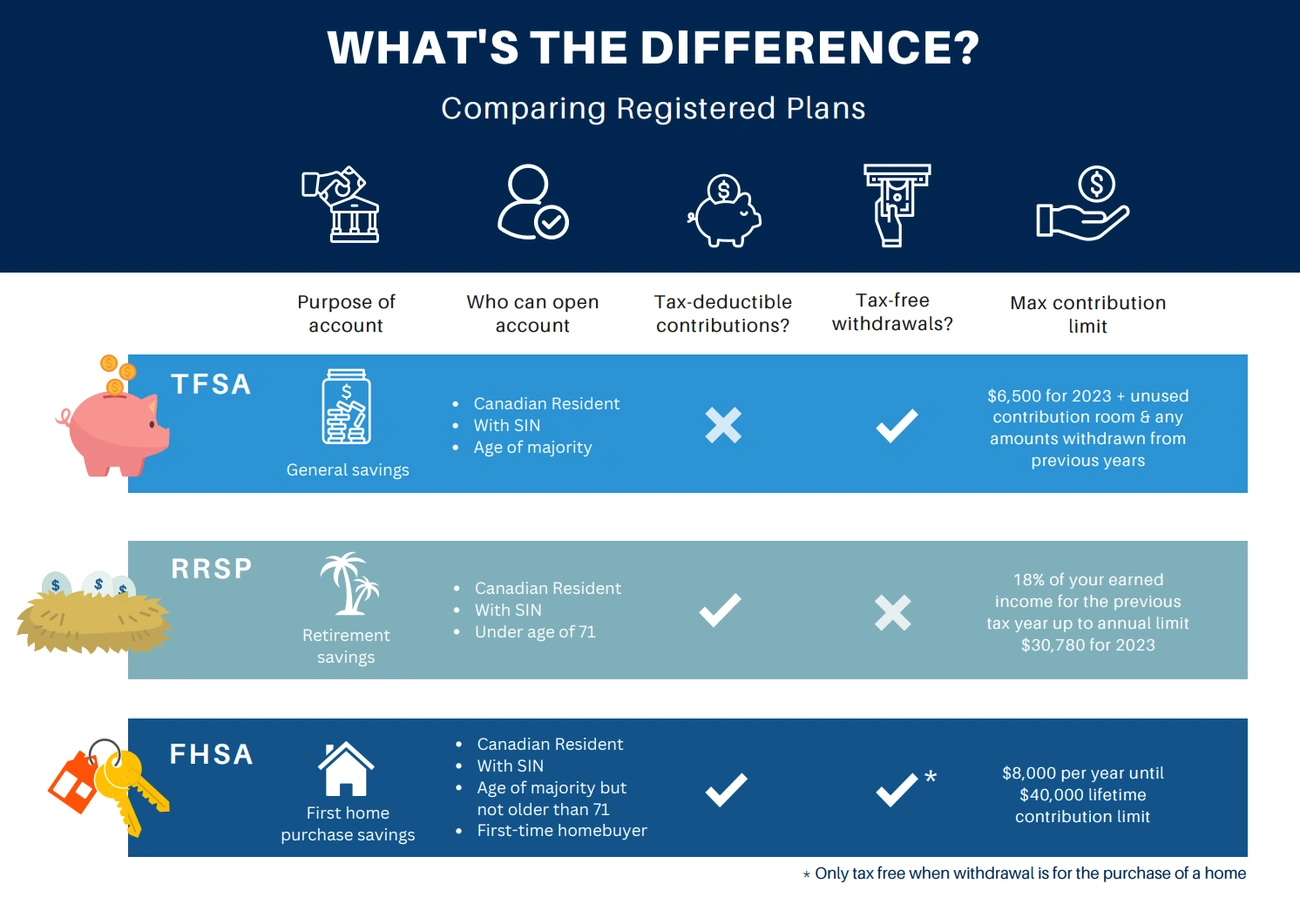

This strategy becomes even more effective when combined with the First Home Savings Account (FHSA). The FHSA lets qualifying individuals contribute up to $40,000 tax-free each (with an annual limit of $8,000) to buy a home. Using both the FHSA and RRSP together can magnify your tax savings by a lot.

Our client couples often set up a joint "house" account to pay all home expenses. This creates a clear financial structure for their new investment. This piece will show you how to make use of information from your RRSP to buy a house, maximize your benefits, and manage the practical side of homebuying as a couple.

Understanding RRSP and FHSA for First-Time Buyers

Image Source: RBC Wealth Management

Canadian first-time homebuyers can take advantage of two valuable programs - the Home Buyers' Plan (HBP) and First Home Savings Account (FHSA).

First-time homebuyers can withdraw up to $83,601.61 from their RRSP without paying taxes. Couples have access to a combined amount of $167,203.22. The funds need repayment to your RRSP within 15 years. This repayment starts during the second year after you take the money out.

The FHSA works differently and lets first-time homebuyers save $11,146.88 each year with a lifetime cap of $55,734.41. The FHSA offers more flexibility because withdrawals don't need repayment. The program gives you tax benefits on both ends - contributions reduce your taxable income, and withdrawals stay tax-free when you buy a qualifying home.

These programs have distinct features:

You must repay HBP funds within 15 years, while FHSA money is yours to keep

HBP caps withdrawals at $83,601.61, yet FHSA lets you take out all contributions plus investment returns

Your RRSP money needs to stay put for 90 days before HBP withdrawal, but FHSA has no waiting period

Smart homebuyers can use both programs together for the same purchase. This approach creates significant tax advantages for couples. A couple could access more than $278,672.04 by combining both programs, which makes buying a home much more realistic.

Step-by-Step: Using RRSP for a Down Payment as a Couple

Image Source: National Bank

You now understand the simple concepts, so let's take a closer look at how couples can use their RRSPs to purchase their dream home.

The process of using your RRSP funds as a couple involves several essential steps:

Verify eligibility - Both partners must qualify as first-time homebuyers (not having owned a home in the previous 4 years) and be Canadian residents.

Ensure 90-day holding period - Your RRSP must hold any funds you plan to withdraw for at least 90 days before withdrawal.

Complete the paperwork - Each partner needs to fill out Form T1036 (Home Buyers' Plan Request to Withdraw Funds) for each withdrawal.

Coordinate your withdrawals - Each partner can withdraw up to $83,601.61 for a combined total of $167,203.22 as of April 2024.

Time your withdrawals properly - Your withdrawals must occur in the same calendar year as your first withdrawal or in January of the following year.

Plan for repayment - Annual repayment of at least 1/15th of the borrowed amount ($5,573.44 per year if you withdraw the maximum) begins in the second year after withdrawal.

First-time buyers who make withdrawals between January 2022 and December 2025 get an extended repayment timeline. Their repayments start five years after withdrawal instead of two.

Note that any portion becomes taxable income if you miss the minimum repayment in any year.

Expert Tips to Maximize Your Home Buying Power

Smart strategic planning helps maximize your home buying power beyond just withdrawing from accounts. Getting pre-approved for a mortgage is a vital first step that confirms your qualification amount, strengthens your offer, and locks in your interest rate for 60-120 days. Sellers will see you as a serious buyer with this preparation.

You might want to use your FHSA funds to cover closing costs since they provide more flexibility. RRSP withdrawals work better specifically for your down payment. Your closing costs typically run 1.5-4% of your home's purchase price. These costs include legal fees (CAD 696.68-1393.40), land transfer tax, home inspection (CAD 348.34-696.68), and appraisal fees (CAD 418.01+).

BC's first-time homebuyers might qualify for property transfer tax exemptions on homes valued up to CAD 696,680.10. Partial exemptions are available for homes between CAD 696,680.10 and CAD 1,198,289.77.

Your property choice should factor in future resale potential. Homes that feature neutral designs, good curb appeal, and prices that line up with neighborhood medians attract more buyers down the road. The neighborhood's future developments could affect property values, so research them thoroughly.

Make sure to coordinate RRSP withdrawals at least 30 days before closing. FHSA withdrawals offer more flexibility with your purchase timeline.

Conclusion

Buying your first home as a couple is one of life's most important milestones. The Canadian government provides strong support through both the RRSP Home Buyers' Plan and First Home Savings Account. These programs can give you access to over $278,672 combined to your down payment and closing costs. BC residents can also take advantage of Property Transfer Tax exemptions for properties valued up to $696,680. This makes the dream of owning a home much more achievable.

The timing of your RRSP withdrawals is vital. You need to make all withdrawals within the same calendar year or by January of the following year. Your funds must stay in your account at least 90 days before withdrawal. Each program has different repayment rules, but proper planning will help these programs work best for your financial situation.

Smart couples often use their RRSP funds for the down payment and keep FHSA money for closing costs. This approach gives you the most flexibility and helps reduce tax implications. Getting pre-approved for your mortgage will strengthen your position with sellers and show exactly how much house you can afford.

BC's minimum down payment rules change based on purchase price. You need 5% for homes under $500,000, 5% on the first $500,000 plus 10% on the remainder for homes between $500,000-$1,000,000, and 20% for properties over $1,000,000. Starting your savings plan early will boost your chances of success.

Of course, this process has many moving parts, but the financial rewards make it worth the effort. Feel free to give me a call if you have questions - I'm always happy to help with your home buying trip! With good planning and smart use of these government programs, you and your partner can make your homeownership dreams real while keeping your long-term finances healthy.

Key Takeaways

Canadian couples can leverage powerful government programs to access substantial funds for their first home purchase, with strategic planning maximizing their buying power.

• Couples can access up to $167,203 tax-free through RRSP Home Buyers' Plan ($83,601 each) plus additional FHSA funds for homebuying

• Combine RRSP and FHSA strategically - use RRSP withdrawals for down payment and FHSA funds for closing costs to maximize flexibility

• Plan timing carefully - RRSP contributions need 90-day holding period, all withdrawals must occur within same calendar year

• Get mortgage pre-approval first to strengthen offers, lock interest rates, and confirm your buying power before house hunting

• Budget 1.5-4% of purchase price for closing costs including legal fees, inspections, and potential land transfer taxes

The key to success lies in coordinating both programs effectively while understanding repayment obligations. RRSP withdrawals require repayment over 15 years, while FHSA withdrawals are permanently tax-free when used for qualifying home purchases.

FAQs

Q1. Can both partners in a couple use the Home Buyers' Plan? Yes, if both partners qualify as first-time homebuyers, each can withdraw up to $83,601.61 from their RRSPs, for a combined total of $167,203.22 under the Home Buyers' Plan.

Q2. Is using an RRSP to buy a house a good financial strategy? While the Home Buyers' Plan can provide access to funds for a down payment, it's important to remember that you're essentially borrowing from your retirement savings. Consider your long-term financial goals and repayment ability before deciding.

Q3. How long do funds need to be in an RRSP before withdrawal under the Home Buyers' Plan? Any funds you plan to withdraw must have been in your RRSP for at least 90 days before withdrawal to be eligible for the Home Buyers' Plan.

Q4. Can the Home Buyers' Plan funds be used for expenses other than the down payment? Yes, while typically used for the down payment, funds withdrawn under the Home Buyers' Plan can be used for any purpose related to buying a home, including closing costs or renovations.

Q5. How does repayment work for the Home Buyers' Plan? Repayment starts in the second year after withdrawal, with a minimum of 1/15th of the borrowed amount due annually. For withdrawals between January 2022 and December 2025, repayments begin five years after withdrawal.